OUR WEBSITE WILL BE UNDERGOING MAINTENANCE TO IMPROVE OUR SERVICE

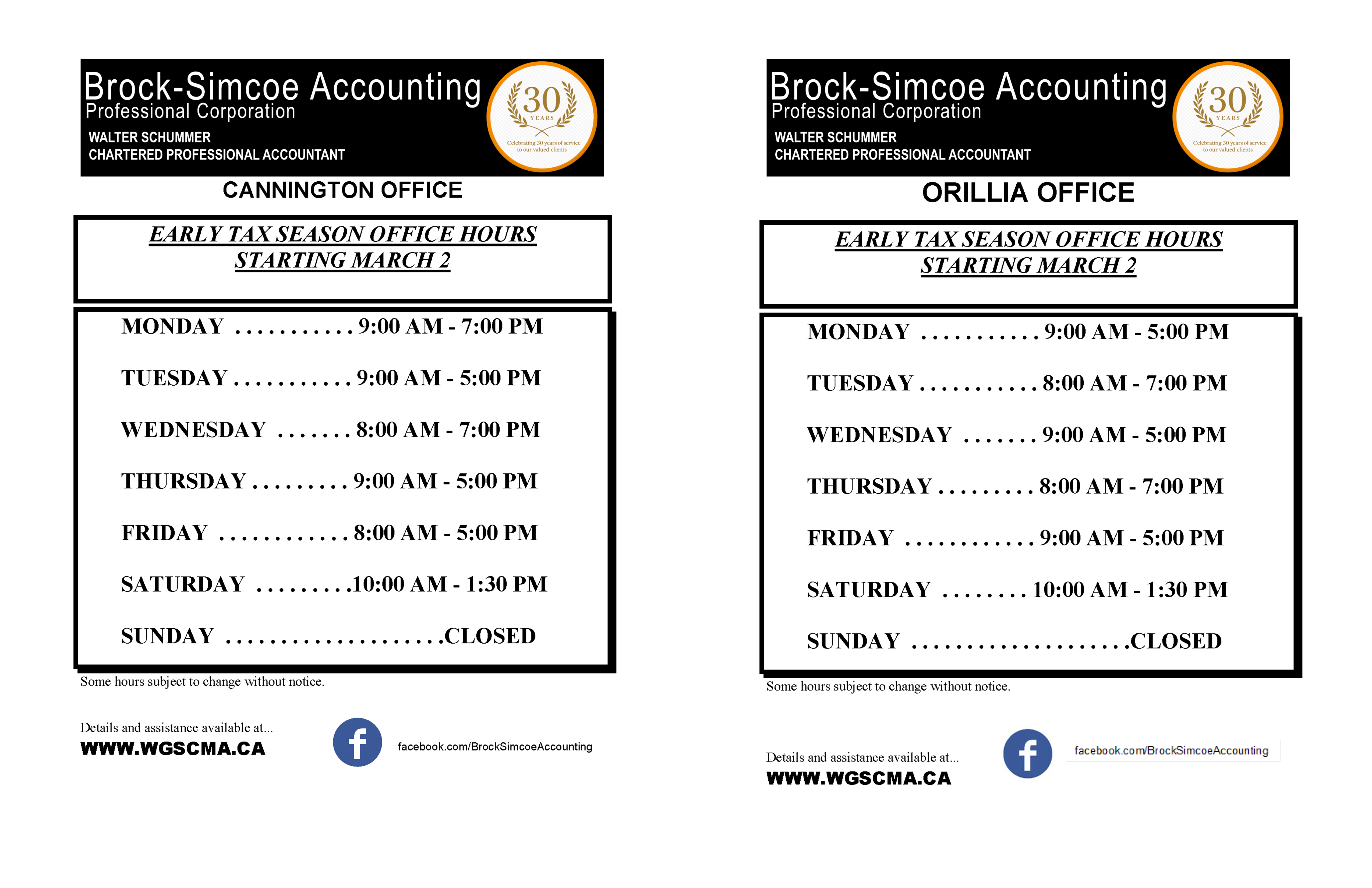

EARLY TAX SEASON HOURS NOW IN EFFECT

EARLY TAX SEASON HOURS IN EFFECT

| |

Our 2025 T1 Tax Season Client Information & Confirmation packages are going out now!

Clients signed up to our secure online portal system should have received them by now.

Email clients are receiving theirs between January 24 and January 27

Client who prefer to receive them by mail will receive them between January 28 and February 4 (subject to Canada Post processing)

The Client Information & Confirmation (CIS) is an extremely important document we ask clients to review, update, sign, and return with your 2025 tax paperwork. It makes sure we have the needed information to prepare your tax return in an accurate and timely way. Also, if you are eligible for billing discounts with our firm your only way to receive the discounts is to complete and return the CIS. We thank you for helping our offices prepare your tax return accurately and efficiently.

If you don't have yours by mid February contact our offices and we'll get another one out to you. Our 2026 Tax Season Newsletter is part of the package. A copy of the newsletter is also available on our Personal Tax Information Page.

| |

30 YEARS OF SERVICE TO OUR CLIENTS

- Income Tax preparation and advisory services

- Accounting and Bookkeeping services to businesses and organizations

- Management and accounting consulting services

- Compliance services

| |

| |

2026 Tax Season

The 2026 personal income tax season is here!

We have over 30 years of experience preparing personal income tax returns for individuals.

Whether your return is "simple" or involves complex financial situations, our expert team is here to provide comprehensive support and guidance including sole proprietor or partnership businesses, investment reporting and taxation, rental activities, multiple jurisdictions, and other complex financial scenarios to help you achieve your goals efficiently while minimizing taxes and insuring compliance with The Income Tax Act.

Our personal income tax webpage is being updated now and will continue to be updated as we move through the tax season. Check it out here.

While we have two convenient offices our client base stretches from coast to coast (and in the US). Our distant clients make the most of our secure online portal system to safely transfer documents and execute their tax documents in full compliance with CRA requirements.

We are ready to assist you with your personal income tax needs and more. Contact us today.

| |

| |

Your personal or business iFirm Portal:

Clients will be receiving emails describing our new iFirm portal service for clients.

This new system will allow clients to submit and retrieve documents electronically in a secure way. E-signatures will also be available for clients who wish to use the service

If you have questions don't hesitate to contact our office

Check out our new  BSA Portal page. You can find information about our secure online portal and instructional videos on how to use it!

BSA Portal page. You can find information about our secure online portal and instructional videos on how to use it!

| |

| |

| |

| |

BROCK-SIMCOE ACCOUNTING PROFESSIONAL CORPORATION provides professional accounting, tax, compliance, and consulting services for a wide range of clients. Our clients include individuals, small business owners, corporations, charities, not-for-profits, and trusts. We have been providing professional services since 1996.

At BROCK-SIMCOE ACCOUNTING PROFESSIONAL CORPORATION,

we work for our clients and their success is our success.

To learn more or request a consultation, please call us today at

Cannington: 705-432-8449.

Orillia: 705-329-2570

102 Peace Street Box 458

CANNINGTON, ON L0E1E0

705-432-8449 866-334-3116

3 Progress Drive Unit 7

ORILLIA, ON L3V-0T7

705-329-2570 866-335-3252