PERSONAL TAX SERVICES AND INFORMATION

Client Information Confirmations are being sent to clients starting late January. Expect to receive yours shortly. Clients who are registered for our secure online portal will receive them in their 2025 portal directory. Clients for whom we have a valid email will receive it that way and remaining clients will receive it by Canada Post later in the month. If you don't receive yours soon contact one of our offices.

Our 2026 Tax Season Newsletter is available and will be sent to each of our clients with your Client Information Confirmation in the coming days. You may also download it here

| |

| |

| |

| |

102 Peace Street Box 458

CANNINGTON, ON L0E1E0

705-432-8449 866-334-3116

| |

3 Progress Drive Unit 7

ORILLIA, ON L3V-0T7

705-329-2570 866-335-3252

Helpful information to prepare for tax season

| |

| |

New Client Checklist

If you are coming to our offices for the first time to have your T1 Personal Income Tax Return(s) completed the following is a quick checklist of the things you should bring with you:

- Valid ID

- Personal information to complete our client information paperwork (address, phone numbers, email, etc)

- The last Notice of (Re)Assessment you received from CRA for the most recent tax year

- Whatever tax paperwork you currently have for the applicable filing year(s)

Information Needed From You

| |

To accurately complete your tax return and meet CRA review requirements the following gives clarification of what our office requires from you to support certain claims on your tax return.

| |

Forms & Receipts

To prepare your return properly, ensure accuracy and correctness, as well as maintain CRA compliance there are some supporting documents our office MUST have in order to make certain claims on your tax return when it is being prepared. The following is a list of items we MUST have from you as well as a list of items it is preferred to have in order to make claims on your T1 Return.

Please note, in the event of a CRA pre or post assessment review if our office was not originally provided documents needed/preferred to justify the claim then you may incur a charge for our services in responding to the review.

MUST HAVE:

THIS LIST PRESUMES YOU WILL PROVIDE ALL TAX SLIPS APPLICABLE TO YOUR SITUATION

- RRSP (AND SIMILAR) CONTRIBUTION RECEIPTS

- FHSA CONTRIBUTION RECEIPTS

- UNION & PROFESSIONAL DUES NOT ON TAX SLIPS

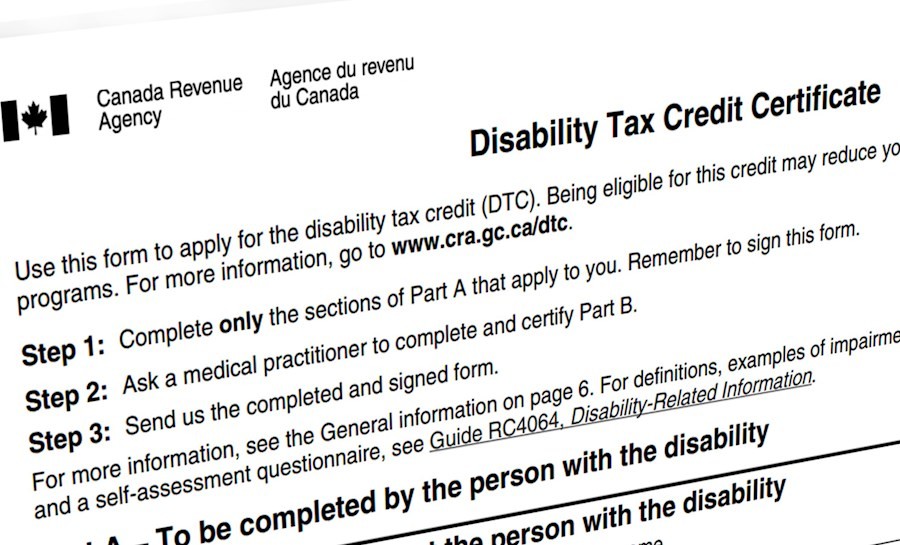

- DISABILITY SUPPORTS DEDUCTION CLAIMS

- BUSINESS INVESTMENT LOSS PAPERWORK

- SUPPORTING MATERIAL FOR EXPLORATION AND DEVELOPMENT EXPENSES

- EMPLOYMENT EXPENSES (T2200 DECLARATION OF CONDITIONS OF EMPLOYMENT)

- CLERGY RESIDENCE DEDUCTION (FORM T1223)

- DOCUMENTS SUPPORTING CLAIM FOR SECURITIES OPTIONS DEDUCTIONS

- DOCUMENTATION FOR ADDITIONAL DEDUCTIONS FOR DONATIONS OF SECURITIES

- NORTHERN RESIDENTS DEDUCTION DETAILS (FORM T2222)

- DIGITAL NEWS SUBSCRIPTION EXPENSES

- INTEREST PAID ON STUDENT LOANS

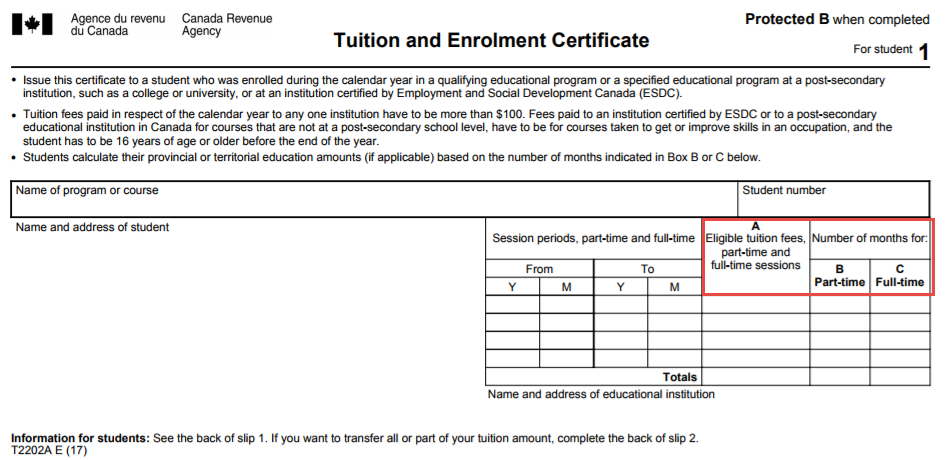

- TUITION (T2202/TL11)

- CHARITABLE DONATIONS

- POLITICAL CONTRIBUTIONS

- TAX INSTALMENT PAYMENTS

- DEDUCTION FOR VOW OF PERPETUAL POVERTY

- DEDUCTION FOR EMPLOYMENT WITH A PRESCRIBED INTERNATIONAL ORGANIZATION

- CLAIMS FOR CERTAIN REPAYMENTS OF GOVERNMENT BENEFITS AND EARNED INCOME

- RESEARCH GRANT DEDUCTIONS

- REPAYMENT OF AN ADVANCE ON A LIFE INSURANCE POLICY

- SHAREHOLDER LOAN REPAYMENTS

- REGISTERED PLAN LOSSES FOLLOWING DEATH

The above list is not comprehensive and other documents may be needed before a final return can be completed.

LIST OF "WE'D LIKE TO HAVE"

- INVESTMENT CARRYING CHARGES ON UNREGISTERED INVESTMENTS

- MEDICAL EXPENSE RECEIPTS

- CHILD CARE RECEIPTS

- RENT AND PROPERTY TAXES PAID

HOME ACCESSIBILITY EXPENSES

HOME BUYERS AMOUNT DOCUMENTATION

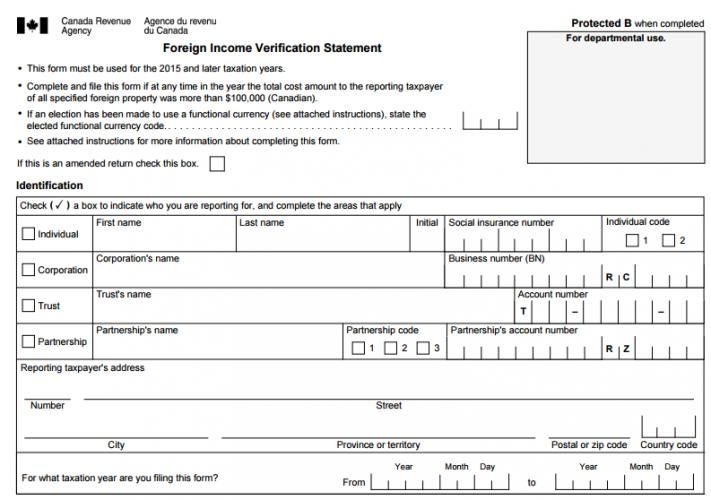

FOREIGN TAX CREDIT CLAIMS

ADOPTION EXPENSE CLAIMS

LEGAL AND ACCOUNTING FOR QUALIFYING EXPENSES

You may be required to provide documented details and figures for the above claims whether you have source documents or not